Reliable. Secure. Since 2012. Exchange Crypto Sign up to get a trading fee discount!

Best Crypto Exchanges

AEX | Binance | Bkex | Bybit | CEX | Changelly | Coinbase | Dex-Trade | Gate | KuCoin | Gemini | HTX | Mexc | Poloniex | Probit | Vindax | XT

AEX | Binance | Bkex | Bybit | CEX | Changelly | Coinbase | Dex-Trade | Gate | KuCoin | Gemini | HTX | Mexc | Poloniex | Probit | Vindax | XT

The under is from a latest version of the Deep Dive, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

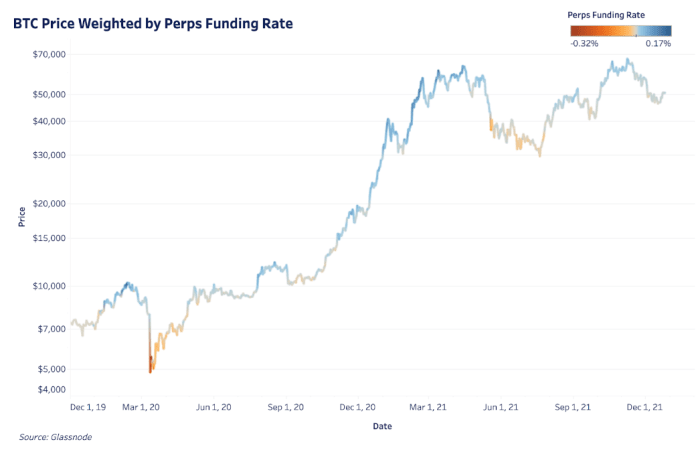

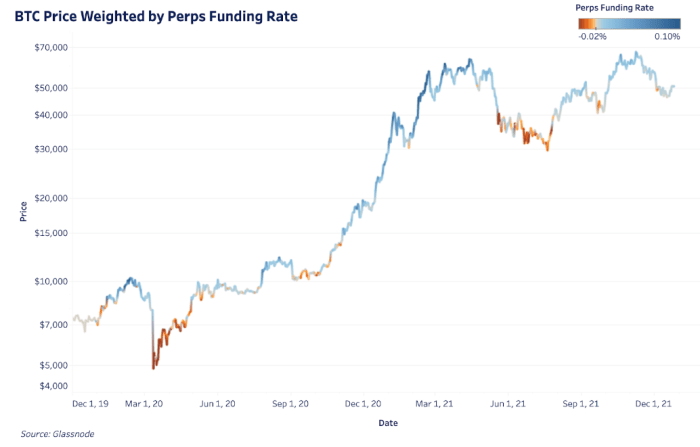

In immediately’s Each day Dive, we’re overlaying some visuals for instance bitcoin’s spot and derivatives market dynamics. We will do that by two key metrics in comparison with value: the futures perpetual funding charge and the long-term holder web place change.

As a refresher, the futures perpetual funding charge was lined extra in-depth in The Each day Dive #097 – Derivatives Market Breakdown. It’s a key charge to look at, particularly when the market is overleveraged to 1 facet with the derivatives market having extra affect over the short-term value.

The 2 charts under present bitcoin value overlaid with the perpetual funding charge. For the reason that market is traditionally biased lengthy, the colour thresholds are lowered within the second chart to higher emphasize durations of any unfavorable funding. General, the charts present when the derivatives market is both inflating or suppressing value.

The darkish blue areas present when the market was overleveraged to the lengthy facet and the darkish purple areas present the other. Every of those excessive durations include subsequent, explosive strikes in value as positions are worn out.

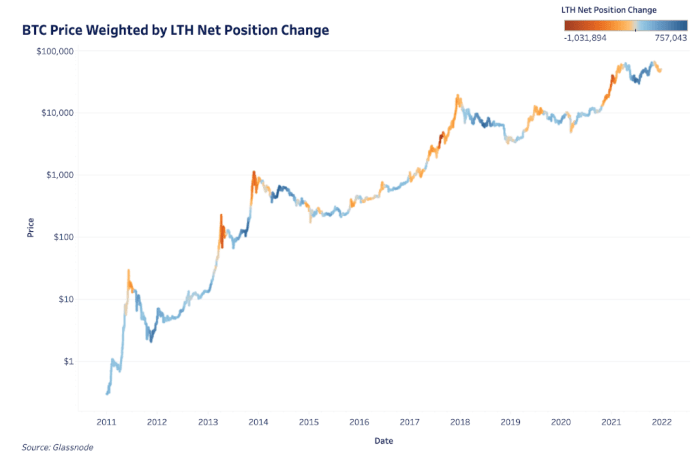

The derivatives market influences value within the quick time period however long-term value is pushed by adoption, sustained spot demand and the conduct of long-term holders. The long-term holder web place change is one strategy to view this conduct because it’s the 30-day change in provide held by long-term holders.

As we’ve lined earlier than, each bitcoin value all-time excessive comes with a major distribution of cash from long-term holders to new market entrants. Durations of darkish purple present this within the under chart whereas durations of darkish blue present comparatively heavy accumulation durations over bitcoin’s lifetime.

#Protecting #Bitcoins #Spot #Derivatives #Market #Dynamics

Related posts:

Crypto Alternate Bitpanda Lists Bitcoin Alternate-Traded Word on Deutsche Boerse

Polygon (MATIC): Close To Breakout?

Survey Shows Expectation of Bitcoin’s Future Value at Low Following FTX Collapse

Scaramucci's SkyBridge Buys Extra Bitcoin, Ethereum Ought to "Keep Disciplined," He Says

This Breast Most cancers Charity Now Accepts Bitcoin, Dogecoin And Shiba Inu As Donation